What is in the Inflation Reduction Act (IRA) of 2022 for architects & builders?

The IRA will rely heavily on the tax code to advance the deployment of clean energy technologies and to combat climate change. It will restore, modify and expand several tax credits and other incentives, while also creating new tax credits. Many of these provisions provide two credit values: a lower base credit and a bonus rate. The bonus rate is equal to five times the base amount, and is available only when requirements related to prevailing wage and apprenticeship are met. Under certain provisions, the IRA also further incentivizes the use of domestic content and placement in identified communities, e.g., energy communities or low-income communities. Another unique feature of the IRA is that it permits tax exempt taxpayers (i.e. non-profits, municipalities, etc.), in particular situations, to elect a direct pay option in lieu of a tax credit, or the option to monetize the credits by transferring them to another entity which will allow tax-exempt entities, municipalities, or political subdivisions to access these incentives

New Energy Efficient Home Credit (Section 45L Tax Credit)

1. The existing 45L tax credit ($2,000 per residential dwelling that qualifies) was extended through Dec. 31, 2022.

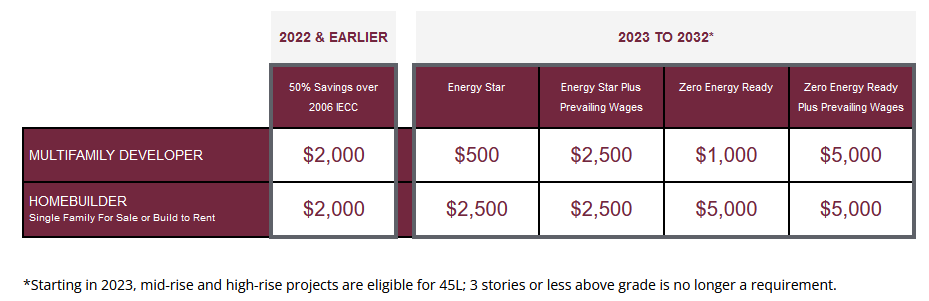

2. Starting January 1, 2023 through Dec. 31, 2032, the 45L tax credit for qualifying energy efficient homes will increase as outlined in the chart below. A bonus credit is offered for multifamily homes if prevailing wage requirements are met during the construction of the units.

3. Eligible contractors, developers, or builders who construct the qualified, energy efficient home. Eligible contractor “must own and have a basis in the qualified energy efficient home during its construction to qualify as an eligible contractor.

4. Partnerships, corporations, estates, association, & trusts

5. Buildings built prior to current tax year can be claimed, but pursuing tax credits for a previous tax year may require amending a previous tax return.

6. Only residential units, new construction, “gut” renovations, substantial reconstruction and rehabilitations can be included.

7. Unused tax credits can be carried forward up to 20 years.

8. 45L tax credit is available to eligible contractor in the year the certified unit/dwellings are leased or sold. Eligible contractors can claim the 45L tax credit 3 years back by amending their previous year’s tax returns or filing an application for tentative refund (form 1045 for individuals or 1139 for corporations).

2. Starting January 1, 2023 through Dec. 31, 2032, the 45L tax credit for qualifying energy efficient homes will increase as outlined in the chart below. A bonus credit is offered for multifamily homes if prevailing wage requirements are met during the construction of the units.

3. Eligible contractors, developers, or builders who construct the qualified, energy efficient home. Eligible contractor “must own and have a basis in the qualified energy efficient home during its construction to qualify as an eligible contractor.

4. Partnerships, corporations, estates, association, & trusts

5. Buildings built prior to current tax year can be claimed, but pursuing tax credits for a previous tax year may require amending a previous tax return.

6. Only residential units, new construction, “gut” renovations, substantial reconstruction and rehabilitations can be included.

7. Unused tax credits can be carried forward up to 20 years.

8. 45L tax credit is available to eligible contractor in the year the certified unit/dwellings are leased or sold. Eligible contractors can claim the 45L tax credit 3 years back by amending their previous year’s tax returns or filing an application for tentative refund (form 1045 for individuals or 1139 for corporations).

Energy Efficient Home Improvement Credit – (Section 25C Tax Credit)

- Beginning in 2023, up to 30% of the cost (material & labor) of an energy efficient upgrade can be claimed as a tax credit. Maximum annual tax credit is $1,200/yr. This credit can be claimed each tax year where an energy efficient upgrade was made. No lifetime cap. Does not need to be the primary residence of the taxpayer.

- Relevant qualified energy efficient upgrades includes but are not limited to: air seal, additional insulation, electric heat pumps, electric heat pump hot water heaters, natural gas or propane water heaters, natural gas or propane condensing furnaces or hot water boilers.

- Maximum tax credit on any one energy upgrade (i.e. new single appliance) is $600/yr.

- A 30% tax credit ($150/max) is provided for home energy audits.

- Maximum annual, aggregate tax credit for exterior windows and skylights is $200. If replacement window(s) meets the highest efficiency Energy Star certification, the maximum annual, aggregate tax credit for exterior windows and skylights is $600.

- Maximum annual, aggregate tax credit for exterior doors is $250. For energy Star labelled exterior doors it is $500.

High Efficiency Electric Home Rebate Program (HEEHRA)

- This program is specifically limited to existing properties with low to moderate income (LMI) owners or tenants. The goal of this program is to help LMI households electrify their homes.

- Funding for this program will pass through the state energy office. The state energy office may or may not have additional requirements.

- For low income properties (<80% Area Median Income or AMI1), up to 100% of the cost of the upgrade (material & labor) can be claimed with a maximum rebate of $14,000.

- For moderate income properties (80-150% Area Median Income or AMI), up to 50% of the cost of the upgrade (material & labor) can be claimed with a maximum rebate of $8,000.

- Qualifying electrification projects include, but are not limited to: heat pump HVAC ($8,000 max), heat pump hot water heaters ($1,750 max), heat pump clothes dryers ($840 max), induction stoves ($840 max), electric stove/cooktops ($840 max), breaker box upgrades ($4,000 max), electric wiring ($2,500 max), weatherization (insulation, air sealing, duct sealing, improved ventilation)

- Up $500 installation costs, commensurate with the scale of upgrades installed & project labor practices

1)For Area Median Income for your area: https://www.huduser.gov/portal/datasets/il/il2022/select_Geography.odn

High Energy Performance Based Whole House Rebate (HOME) Program

- This program is for energy efficiency projects on existing households regardless of income. The goal of this program is to help households decrease their energy consumption.

- Although this program is for all income households, additional rebates are available for low to moderate income (LMI) households (<150% Area Median Income or AMI).

- These projects will require a residential energy auditor or rater.

- Funding for this program will pass through the state energy office. The state energy office may or may not have additional requirements.

- Based on computer energy modeled performance or predicted decrease in energy bill (yes, this program is complicated)

- For computer energy model performance rebates for LMI households, energy savings of the upgrade must be at least 20% of the modeled annual energy consumption. If modeled energy savings is between 20-35% of the modeled annual energy consumption, the rebate is 80% of the project costs with a maximum rebate of $4,000. If modeled energy savings is > 35% of the modeled annual energy consumption, the rebate is 80% of the project costs with a maximum rebate of $8,000.

- For computer energy model performance rebates for standard (i.e. non-LMI) households, energy savings of the upgrade must be at least 20% of the modeled annual energy consumption. If modeled energy savings is between 20-35% of the modeled annual energy consumption, the rebate is 50% of the project costs with a maximum rebate of $2,000. If modeled energy savings is > 35% of the modeled annual energy consumption, the rebate is 50% of the project costs with a maximum rebate of $4,000.

- For measured performance rebates for LMI households, energy savings of the upgrade must be at least 15% of the annual energy consumption. Calculate the energy savings incentive2. If the energy savings incentive for the project is <80% of project costs, the rebate amount is the energy savings incentive amount. If the energy savings incentive is > 80% of the project cost, then the rebate amount is 80% of the project cost.

- Fore measured performance rebates for standard (non-LMI households), energy savings of the upgrade must be at least 15% of the annual energy consumption. Calculate the energy savings incentive3. If the energy savings incentive for the project is <50% of project costs, the rebate amount is the energy savings incentive amount. If the energy savings incentive.

2) Calculate $/kWh savings or kWh equivalent: $4,000 ÷ (avg. state home energy use x 0.2). Then multiple this value by the kWh saved.

3) Calculate $/kWh savings or kWh equivalent: $2,000 ÷ (avg. state home energy use x 0.2). Then multiple this value by the kWh saved